REFORM ON DISTANCE SALES

THE ONE STOP SHOP

OSS EU / OSS non-EU / IOS

CONTEXT

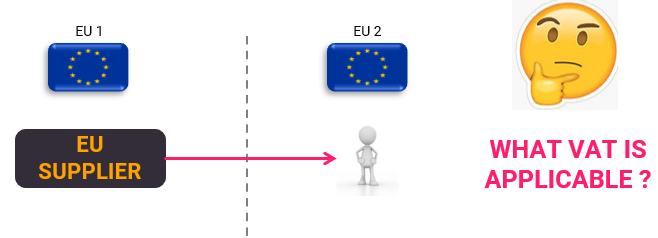

A distance sale is a delivery of good meeting the three following conditions :

- The supplier is a taxable person,

- The supply is made to a non-taxable person (B2C),

- Goods are shipped from a Member State different than the Member State of arrival.

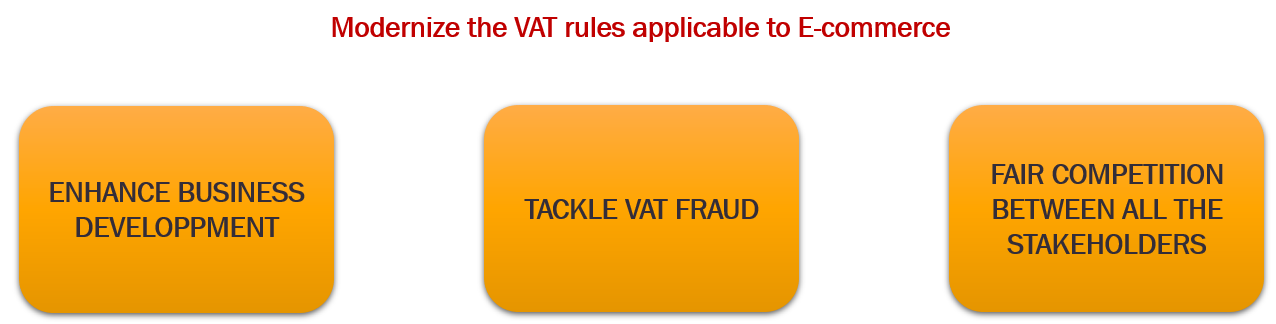

PURPOSE OF THE REFORM

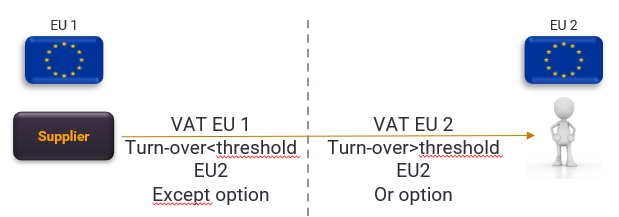

- Obsolete VAT rules not adapted to the internet

- No harmonization between Member states :

- Different thresholds,

- Different VAT registration process,

- Different requirements,

- Risks related to misreading of the applicable rules,

- E-commerce represents a significant part of the VAT GAP (difference between the amount of VAT expected and the amount of VAT actually collected by the states),

- Unfair competition between EU and non-EU players linked to the exemption from import VAT on low-value goods.

IMPLEMENTATION OF THE REFORM

The reform is in force since July 1st 2021

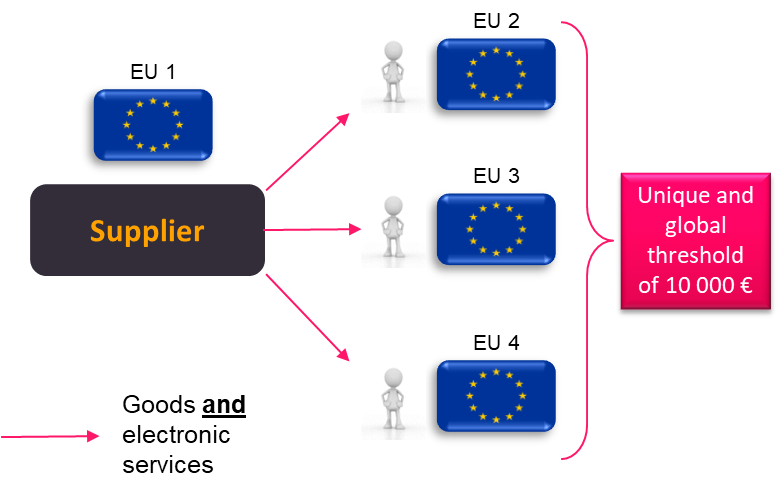

1/ A unique and global threshold

1/ A unique and global threshold

2/ A new definition for distance sales

The notion of transport has been added to the definition of distance sales by specifying that the seller must be directly or indirectly involved in the transport of the goods.

3/ A new regime of Distance sales of imported goods

3/ A new regime of Distance sales of imported goods

Distance sales of imported goods are characterized by the delivery of goods from a country located outside the European Union directly to a non-taxable person (B2C) located in the European Union.

The import VAT exemption on low value goods (<22 EUR) has been removed. Thus, all imports are subject to import VAT.

These sales are taxable in the Member State of arrival of the goods.

These sales are taxable in the Member State of arrival of the goods.

When the intrinsic value of the parcel does not exceed EUR 150, the taxpayer can opt to declare the VAT in the I-OSS one-stop shop. He then benefits from an exemption from import VAT.

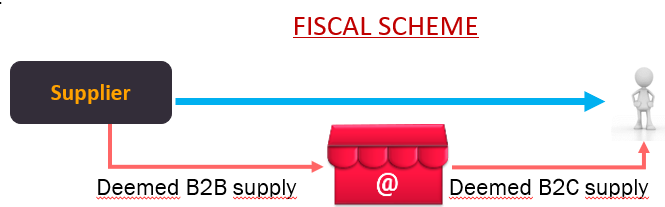

4/ Liability of the Marketplaces (deemed supplier)

4/ Liability of the Marketplaces (deemed supplier)

Certain transactions carried out through a Marketplace designate the latter as the person liable for VAT. The Marketplace then acts as the presumed supplier.

It is in charge of collecting VAT.

5/ New reporting tools

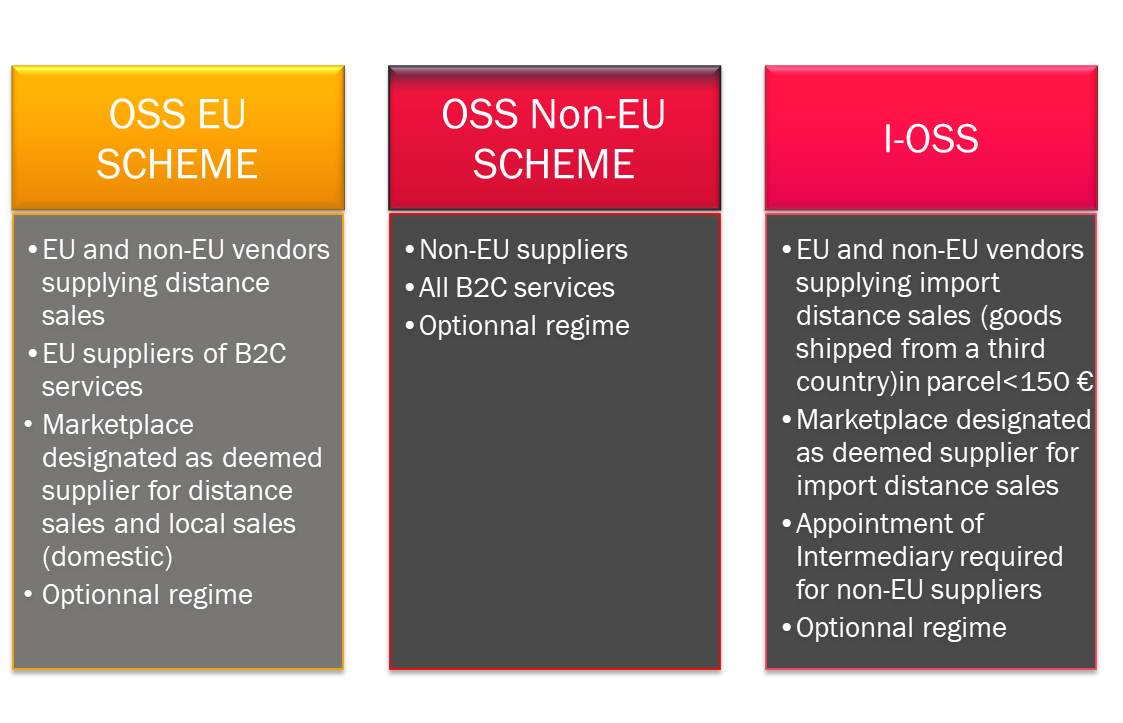

New reporting tools were introduced with the reform. The One Stop Shop (formerly MOSS Mini One Stop Shop) has been expanded and divided into 3 counters:

New reporting tools were introduced with the reform. The One Stop Shop (formerly MOSS Mini One Stop Shop) has been expanded and divided into 3 counters:

- One Stop Shop Union Scheme (OSS EU) for intra-Community distance sales made by taxable persons established or not in the European Union (including marketplaces), and VAT on B2C services provided by taxable persons established in the EU.

- One Stop Shop Non-Union Scheme (OSS Non-EU) for B2C services provided by taxable persons not established in the EU.

- Import One Stop Shop (IOSS) for distance sales of imported goods carried out by a taxable person established or not in the EU (including marketplaces) and whose value of the parcel does not exceed 150 EUR.

These tools are optionnal.

Only the transactions concerned can be declared in these declarative tools.

A company may be eligible for several reporting regimes depending on the transactions it must report

For any additional information, to obtain a quote or assistance on this subject, do not hesitate to contact us : Vatcustomerservice@tevea.fr